Marketplace Pulse: Mixed Harvest

The Marketplace Pulse series provides expert insights on timely policy topics related to the health insurance marketplaces. The series, authored by RWJF Senior Policy Adviser Katherine Hempstead, analyzes changes in the individual market; shifting carrier trends; nationwide insurance data; and more to help states, researchers, and policymakers better understand the pulse of the marketplace.

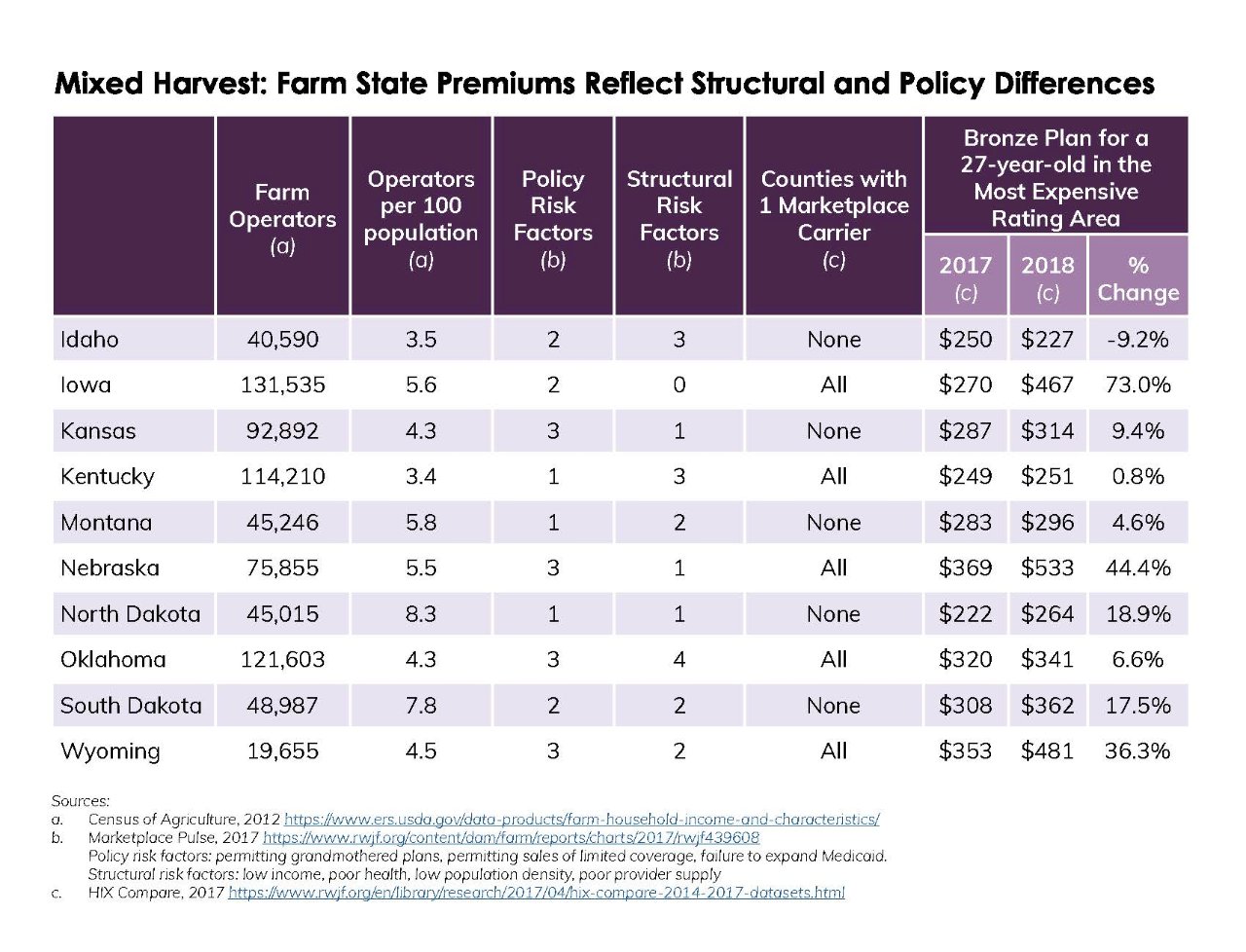

Many have bemoaned the state of the current individual market in rural states. As we have seen, the 2018 plan year has been relatively unkind to the unsubsidized, and generally, the farm population is more likely to live in states with less well-functioning individual markets, due to a combination of both policy and structural risk factors.

While many U.S. farms today are managed by employees of giant corporations, the United States still counts more than 3 million farmers, or "farm operators" in the United States as termed by the most recent Census of Agriculture. Despite their relatively small numbers, farmers are an important economic and political constituency in many states. While some farmers and/or their spouses have off-farm jobs that provide insurance, many are self-employed, and therefore more likely to be uninsured or in need of individual coverage. In fact, 14 percent of farm operators were uninsured in 2015, and 17 percent purchased insurance in the individual market.

Compounding those demographics, farm operators, as a group, are not young. In 2015, only 8 percent were younger than 35 years old, and their household income averaged approximately $120,000 (roughly double the national average), suggesting that they would be likely to have a fairly strong demand for health insurance and a relatively low likelihood of qualifying for subsidies. In 2015, the average farmer spent more than $5,400 on premiums and out-of-pocket expenses.

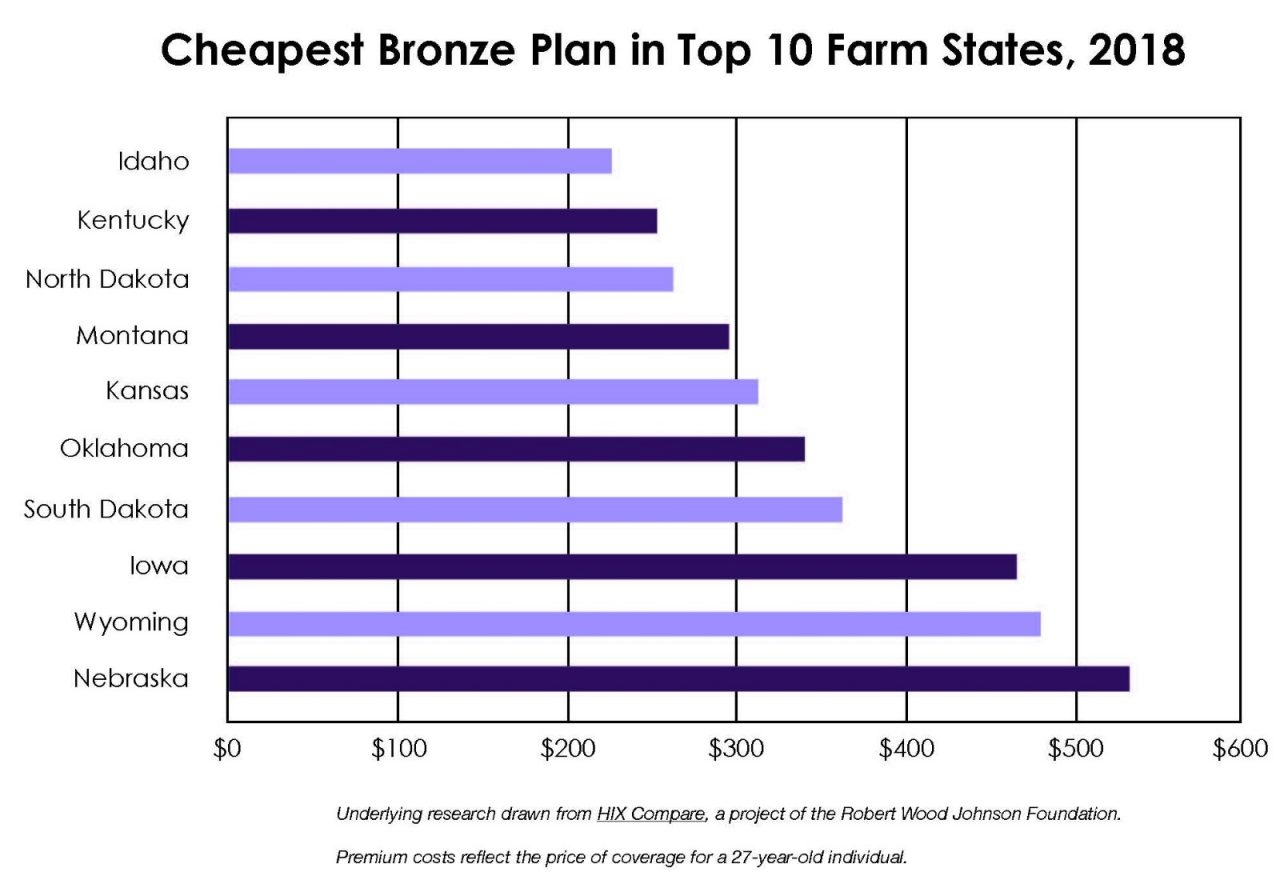

Yet looking more closely at top 10 farm states, as measured by farmers as a share of population, they reflect a wide range of outcomes. Because many farmers are unsubsidized, we compare the premium for the cheapest bronze plan available either on or off the exchange, choosing the most expensive rating area in the state. Some states, such as Idaho, Montana, and North Dakota, have greater participation and lower premiums than states like Nebraska, Iowa, and Wyoming. Depending on their county of residence, a farmer in Nebraska will pay more than twice as much for the cheapest bronze plan compared to a farmer in Idaho.

Many factors help to explain these large differences. For example, very rural Wyoming is considered to be a state with above-average medical costs, at least from the standpoint of its group insurance premiums. However, the state policy environment is probably relevant. States with higher premiums and larger increases in premiums are more likely to have policies which have been identified as risk factors for poor market outcomes, such as permitting grandmothered plans and the sale of limited coverage products. Nebraska and Wyoming, for example, have three policy risk factors apiece, while Idaho and North Dakota have one or two. This simple comparison does not account for other relevant state differences. While many states have permitted grandmothered plans, enrollment is often relatively small. However, Iowa has a very large grandmothered plan, so the impact on their market is probably greater. The fact that the state Blue plan does not participate in the ACA-compliant market in either Iowa or Nebraska probably makes things worse in these states than they would be otherwise.

Aggressive advertising for non-compliant plans aimed at unsubsidized consumers have even prompted stark consumer warnings. In Iowa, the Insurance Department warned of “outright fraudulent calls” from marketers of plans that offer inadequate coverage and would not exempt consumers from the individual mandate’s requirement. A department spokesman explained: “If people choose to have something rather than nothing, they should go into it with their eyes open.” While this grim advice is perhaps appropriate, a different policy environment could have led to a better set of choices for consumers.

Despite the calls for more state flexibility in the implementation of the ACA, there is ample evidence that the impact of state decision-making on premiums and carrier participation has already been considerable. In a world with no individual mandate and expanded opportunities to sell non-comprehensive coverage, the divisions between states will likely deepen, and market conditions will deteriorate further for unsubsidized farmers and others seeking comprehensive coverage in states that don’t protect their risk pool.

Related Content

Marketplace Pulse: Off the Cliff in Farm Country

Marketplace Pulse: Bronze Plans with Premiums of $50 or Less Become Scarce in 2026