Marketplace Pulse: Plan-Spreading

The Marketplace Pulse series provides expert insights on timely policy topics related to the health insurance marketplaces. The series, authored by RWJF Senior Policy Adviser Katherine Hempstead, analyzes changes in the individual market; shifting carrier trends; nationwide insurance data; and more to help states, researchers, and policymakers better understand the pulse of the marketplace.

For the second year in a row, there has been a net increase in carrier participation in the individual market.

All in all, there were 26 entries into new states and 56 expansions within states. While approximately 35 carriers increased their participation in at least one state, four carriers contributed the most to this increase—Centene, Oscar, Bright Health and Molina. Together, they account for one-half of all entries and one-third of expansions.

The increase in participation has been widely recognized, but there has also been a sizable increase in the number of plans being offered, only some of which reflects participation in new markets. Overall, there was a 25 percent rise in the number of plans available between 2019 and 2020, from 2,118 to 2,651.1 A little less than half (43%) reflects entry into new states, 25 percent reflects new plans in states where carriers have expanded their territory, and approximately one-third comes from increased offerings by carriers in territories in which their participation has not changed.

To what extent did the four carriers that made the biggest contribution to increased participation expand their offerings? Together, they account for more than half of the overall increase in plans. About one-fifth (21%) of the increase in plans is from Centene, 13 percent from Oscar, 12 percent from Bright Health, and 9 percent from Molina.

Centene

Centene had more plans than any carrier in 2019, and they nearly doubled their offerings for 2020. All of its new 2020 plans are being sold in states where they already have a presence, although they increased their footprint in some places. For Centene, the increase in markets and plans in 2020 is limited to states in which they use the Ambetter brand. The increase is not trivial. The median number of plans offered by state by Ambetter increased from seven in 2019 to 14.5 in 2020, and the number of plans sold increased in all but one of the states where they offer plans. Some of this increase reflected new benefit designs, including a $0 deductible silver plan, as well as expanding the number of plans including vision and/or dental. For example, in Kansas Ambetter offered two different silver plans in 2019. In 2020 they will offer seven, most of which have an option that includes dental and vision, with deductibles ranging from $0 to $7,350.

Oscar and Bright Health

Most of Oscar’s increase in plans reflected entry into new states. They added several plans in existing states, most commonly a new silver plan and a zero-deductible bronze. Bright Health behaved similarly, adding a small number of new silver and bronze plans to existing territory, but mostly issuing new plans in states they were entering.

Molina

Molina is unique because it had far fewer plans than other carriers in 2019. Its median number of plans increased quite a bit, from two to eight. In states where Molina had only two plans in 2019, they typically offered only one silver and one gold. For 2020, they introduced more options including bronze, silver, and gold plans, some with vision included. Molina had a $0 deductible silver plan in 2019 and has one in 2020, but only in Texas.

Thoughts for Consumers

In the early days of the individual market, there was a proliferation of plans. At the height of the market in 2016, there were 3,764 plans. In those early days, the question of how much choice was “too much” was a lively topic of debate, and some state-based marketplaces took steps to standardize plan design, most notably California. In 2017, CMS debuted the “Simple Choice” concept, a standard design for each metal. But by then, many carriers were fleeing the market—shedding plans, reducing territory, and sometimes exiting completely. The question of plan standardization became somewhat esoteric in the context of greatly reduced insurer participation and worries about bare counties.

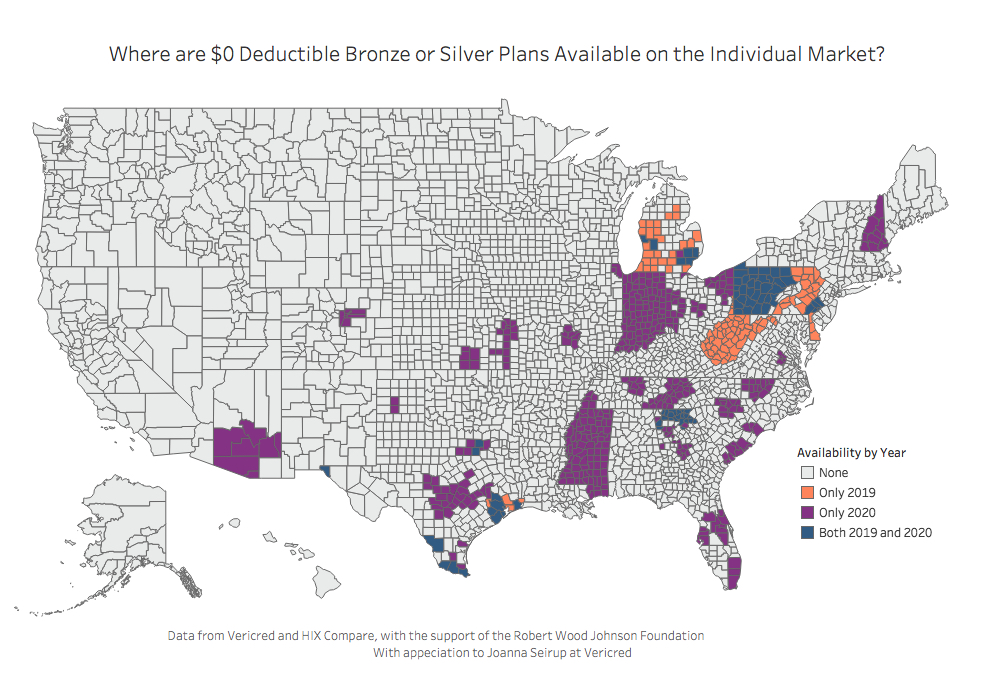

While participation increased in 2019, the number of plans per issuer did not, so this year’s development marks the reversal of a multi-year trend. One of the first kinds of plans to be thrown overboard when the market started to contract were PPO or POS plans that included out-of-network benefits. That trend has not reversed, and new plan offerings in 2020 are mostly health maintenance organization or exclusive provider organization designs. Interestingly, there has been no major increase in plans with health savings account options. Consumers will mostly find a wider range of deductible levels, particularly in the silver level. One type of plan that increased slightly is a zero-deductible bronze or silver plan. In 2020, 13 percent of counties gained a zero-deductible low metal plan, 2.5 percent already had one, and another 2.5 percent lost one. With a growing number of states thinking about creating their own marketplace, there may be an increased interest in standardized plans if this trend continues. In part, this will depend on whether consumers view this proliferation of new options with relief or with confusion.

_________________________

[1] Because carriers can file the same plan more than once in different areas of the same state, the number of plans being sold by a carrier in a state is measured here as the maximum number of plans available from an issuer in any one county. We included only on-market, individual plans and removed all cost sharing reduction plan variants and child-only plans.

Related Content

Marketplace Pulse: Cost-Sharing for Drugs Rises Sharply at Higher Tiers

Marketplace Pulse: Are the Markets Ready for the HRA Rule?